However, for sectors like technology and pharmaceuticals, where intellectual property and ongoing research and development are crucial, BVPS can be misleading. Investors use BVPS to gauge whether a stock is trading below or above its intrinsic value. InvestingPro offers detailed insights into companies’ Book Value Per Share including sector benchmarks and competitor analysis.

P/B Ratios and Public Companies

For example, let’s say that ABC Corporation has total equity of $1,000,000 and 1,000,000 shares outstanding. This means that each share of stock would be worth $1 if the company got liquidated. Book value per share is the portion of a company’s equity that’s attributed to each share of common stock if the company gets liquidated. It’s a measure of what shareholders would theoretically get if they sold all of the assets of the company and paid off all of its liabilities. Closely related to the P/B ratio is the price-to-tangible-book value ratio (PTVB). The latter is a valuation ratio expressing the price of a security compared to its hard (or tangible) book value as reported in the company’s balance sheet.

Methods to Increase the Book Value Per Share

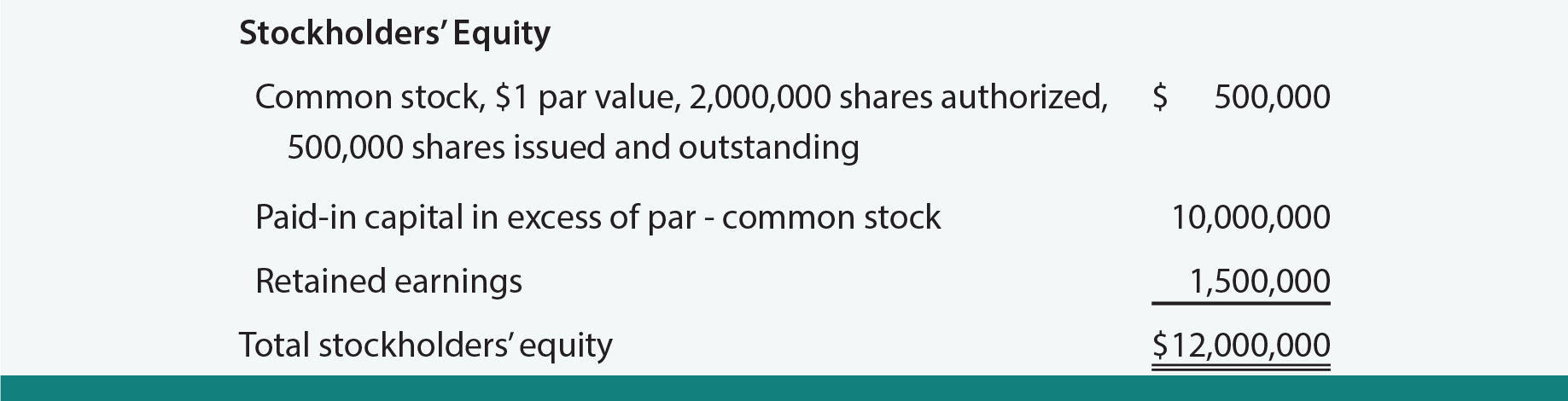

To obtain the figure for total common shareholders’ equity, take the figure for total shareholders’ equity and subtract any preferred stock value. If there is no preferred stock, then simply use the figure for total shareholder equity. If a company’s book value per share exceeds its current stock price, the stock is considered undervalued.

Best Short Term Stocks to Buy In India

- But if the stock holds negative book value, then it represents a company’s liabilities are more than its assets, resulting in balance sheet insolvency.

- If XYZ can generate higher profits and use those profits to buy more assets or reduce liabilities, the firm’s common equity increases.

- For example, a company can use profits to either purchase more company assets, pay off debts, or both.

- Now, let’s say that you’re considering investing in either Company A or Company B. Given that Company B has a higher book value per share, you might find it tempting to invest in that company.

- This means that each share of the company would be worth $8 if the company got liquidated.

- Now, let’s say that the company invests in a new piece of equipment that costs $500,000.

Book Value Per Share (BVPS) is a crucial financial metric that indicates the per-share value of a company’s equity available to common shareholders. It helps investors determine if a stock is overvalued or undervalued based on the company’s actual worth. The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share. BVPS is what shareholders receive if the firm is liquidated, all tangible assets are sold, and all liabilities are paid. Book value per share (BVPS) measures the book value of a firm on a per-share basis. BVPS is found by dividing equity available to common shareholders by the number of outstanding shares.

The following image shows Coca-Cola’s “Equity Attributable to Shareowners” line at the bottom of its Shareowners’ Equity section. In this case, that total of $24.1 peanut butter price history from 1997 through 2021 billion would be the book value of Coca-Cola. It’s one metric that an investor may look for if they’re interested in valuating Coca-Cola as a potential investment.

Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business. There are other factors that you need to take into consideration before making an investment. However, book value per share can be a useful metric to keep in mind when you’re analyzing potential investments.

Knowing what book value per share is, how to calculate it, and how it differs from other calculations, can add yet another tool to an investor’s tool chest. The term “book value” is derived from accounting lingo, where the accounting journal and ledger are known as a company’s books. As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from the latest financial report (e.g. 10-K, 10-Q). Investors typically view a P/B ratio below 1.0 as an indication of undervaluation. Although the meaning of a “good PB value” differs by industry, some experts consider any value below 3.0 to be favourable. Remember, even if a company has a high book value per share, there’s no guarantee that it will be a successful investment.

The price-to-book ratio may not be as useful when evaluating the stock of a company with fewer tangible assets on its balance sheets, such as services firms and software development companies. The P/B ratio reflects the value that market participants attach to a company’s equity relative to the book value of its equity. By purchasing an undervalued stock, they hope to be rewarded when the market realizes the stock is undervalued and returns its price to where it should be—according to the investor’s analysis. Book value is the value of a company’s assets after netting out its liabilities. It approximates the total value shareholders would receive if the company were liquidated. Often called shareholders equity, the “book value of equity” is an accrual accounting-based metric prepared for bookkeeping purposes and recorded on the balance sheet.

Market value per share is obtained by looking at the information available on most stock tracking websites. You need to find the company’s balance sheet to obtain total assets, total liabilities, and outstanding shares. Most investment websites display this financial report under a “financials” tab—some show it on a stock’s summary tab. There are many methods that investors can use to evaluate the value of a company.

An asset value at which it can be sold matters as it is used to pay shareholders at liquidation. It may be that a company has equipment that gets depreciated rapidly, but the book value is overstated. In contrast, a company may have an asset that does not depreciate rapidly, like oil and property, but it has been overlooked and has understated book value. However, when accounting standards applied by firms vary, P/B ratios may not be comparable, especially for companies from different countries. Even though book value per share isn’t perfect, it’s still a useful metric to keep in mind when you’re analyzing potential investments.

It compares a share’s market price to its book value, essentially showing the value given by the market for each dollar of the company’s net worth. When searching for undervalued stocks, investors should consider multiple valuation measures to complement the P/B ratio. The P/B ratio can also be used for firms with positive book values and negative earnings since negative earnings render price-to-earnings ratios useless. There are fewer companies with negative book values than companies with negative earnings.